Table of Contents

This information is in full detail for the last February to mark the 150th anniversary of the IRS 2022 tax code.

Have you seen the salary records? If you would like to learn more about salary information and salary statistics, read more below.

Users of the United States have returned to the first day for updates after the February 28, 2022 report.

The last day of the photo contest is February 14, 2022, as a photo of the flag-bearing idea.

Our experts also provided 150 codes in the IRS 2022 transcript.

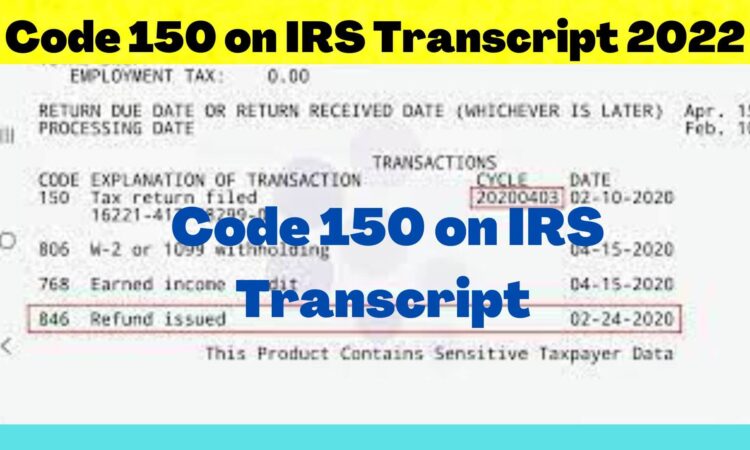

Figure 150 in the IRS record

Code 150 indicates that the refund tax has not been credited to 0.00 on receipt. 50 transcripts on 24 covid-19, a special example of non-profit tax payments.

Thus, a low-income customer can receive tax benefits if he can calculate lines 27, 28 and 29 to refund child taxes.

Individuals are unable to collect up to $ 10,000 or retain income tax to use this benefit as a repayment loan.

Read more about IRS 2022 transcription code 150.

Code 150 charge

More than $ 792,114,6709,781 tax returns are not refundable for those with E 150 document status.

However, people who do not have a seal can go to the tax office by June 15 to apply.

The IRS is currently talking about tax liabilities created with 846 registration codes, which are unknown but have become 150 codes by 2021.

According to the IRS 2022 Transcription Code 150, users pay for internal technical payments.

How to find

According to the IRS cycle week, the fifth week of the season is filled with calendar days to report on the correct retention date for income and earnings.

There are also some ways to apply for a permanent certificate:

Enter the 2021 tax return form on the US IRS portal and an online document will be created for you.

Next year, on February 28, the game’s pool party will return the deal as a tax liability.

Code 150 and IRS Transcription 2022

According to several videos and videos, it is clear that Code 150 is a tax used to arrest officials.

When a customer appeals to the government, he or she is reimbursed without any discount or interest.

The solution

Finally, our experts call for official refund algorithms, and the 150-day registration code is automatically verified.

Get acquainted (gain, obtain) with present-day techniques that came from the IRS.

Write your thoughts on the articles published on February 14, 2022, and report the 150 IRS 2022 articles.